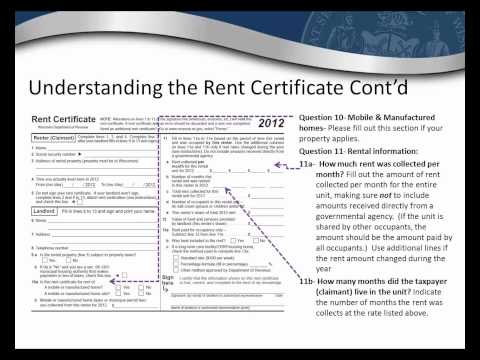

Hello, thank you for joining the Wisconsin Department of Revenue for our webinar. We will be discussing the Wisconsin Homestead Credit for landlords and property managers. My name is Tommy Jones, the revenue tax specialist at the Department of Revenue, and I will be your presenter. In this presentation, you will learn how to properly fill out a rent certificate for your tenants, how to avoid the need for redoing rent certificates, and how to prepare the landlord section of the rent certificate. It is important to answer each question listed in that section. You will also learn where to find educational material and information on the Homestead Credit program. Now, let's delve into our presentation on understanding Wisconsin Homestead Credit for landlords and property managers. The Homestead Credit program is designed to alleviate the burden of property taxes and rent by providing economic assistance in the form of a refundable credit. It was created in 1964 by the Wisconsin State Legislature. A few important facts about the program: The maximum credit a taxpayer could receive in 2012 was $1,168. In 2004, the Department of Revenue created the H-EZ form to simplify the filing process for taxpayers with simple tax returns who received the Homestead Credit. The program has assisted 251,000 taxpayers in 2012 and has provided over $137 million in support to the Wisconsin economy. Now, you may wonder why Wisconsin landlords and property owners are so important. Your property tax payments contribute to funding our public schools, infrastructure, and overall economy. By accurately filling out rent certificates for your tenants, you help the Wisconsin Department of Revenue ensure accurate information for the Homestead Credit program. As a landlord or property manager, your main goal is to fill out your tenants' rent certificates. If your property is subject to...

Award-winning PDF software

Wisconsin real estate condition report fillable Form: What You Should Know

The application should be completed in black ink. The form should have all the information that are required from the applicant. This will consist of the following: If you are applying for a specialty, state the name of the specialty The name of the training facility (if applicable) The education and training hours obtained (no more than 16) and any specialties (if the individual has more than one specialty, the last specialty listed will be entered) The education or training dates and degree, if any, completed If you wish to update the education and training information on your form (e.g. change the date), please complete all the following columns on VA Form 10-2850D. If you wish to get certified, this is important. You should fill out this column first. If you would like to get certified you need to have the information correct on any of the required fields of the form. The last time you attended a specialty training facility the degree, number of training hours, and specialty certification should all be on the VA form. A certificate is NOT required to obtain a certification. INSTRUCTIONS TO AVOID TAKEOFF OF YOURSELF FROM A SPECIALTY TRAINING FACILITY ON VETERANS BENEFIT TRAINER (SON) CERTIFICATION. If you are not a qualified medical resident, this can cause a delay in receiving certification which would affect veteran patients services if received. The SON must hold a valid federal medical certification in his/her field. If you don't have a medical SON must file a form with VA in FEDERAL OR STATE OF THE U.S. OR DIFFERENT LOCATIONS, AND submit INSTRUCTIONS TO AVOID TRAINING FOR PROFESSIONAL EDUCATION TRAINING FACILITY, OR FEDERAL RESERVE CERTIFICATE, ETC. The SON must be on the certified list when you get an APPOINTMENT to work out of a specialty training clinic. ONLY those individuals who complete specialty training will have their names listed on the list. Include information on your education and training from a medical institution.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do WI WB-11 2011-2025, steer clear of blunders along with furnish it in a timely manner:

How to complete any WI WB-11 2011-2025 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your WI WB-11 2011-2025 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your WI WB-11 2011-2025 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Wisconsin real estate condition report fillable